Advertisement

-

Published Date

March 23, 2022This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

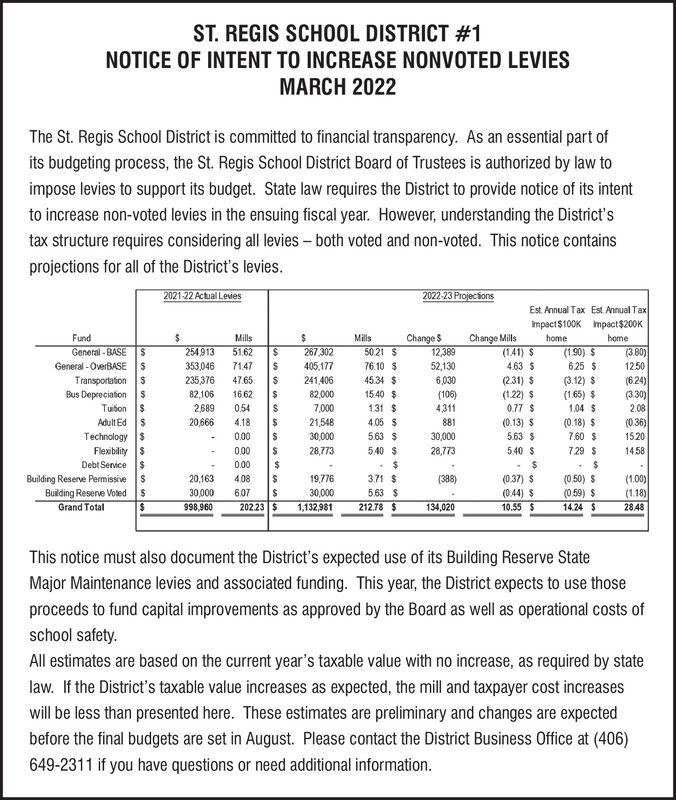

ST. REGIS SCH0OOL DISTRICT #1 NOTICE OF INTENT TO INCREASE NONVOTED LEVIES MARCH 2022 The St. Regis School District is committed to financial transparency. As an essential part of its budgeting process, the St. Regis School District Board of Trustees is authorized by law to impose levies to support its budget. State law requires the District to provide notice of its intent to increase non-voted levies in the ensuing fiscal year. However, understanding the District's tax structure requires considering all levies both voted and non-voted. This notice contains projections for all of the District's levies. 2021-22 Actual Leves 2022-23 Projecions Est Annual Tax Est. Annual Tax Impact$100K mpact $200K Fund Change Mills Mills Mills Change S home home General - BASE General - OverBASE S Transportation $ Bus Depreciation s 254,913 51.62 267,302 50.21 $ 12,389 (141) $ (1.90) $ (3.80) 353,046 7147 405,177 76.10 $ 52,130 4.63 $ 625 $ 12.50 6,030 (106) (3.12) $ (1.65) $ 1.04 $ 235,376 47.65 241,406 45.34 $ (231) $ (1.22) $ (6.24) (3.30) 2.08 82,106 16.62 82,000 15.40 $ Tuiton 24 2,689 0.54 7,000 1.31 $ 4,311 0.77 $ Adult Ed 20,666 4.18 21,548 (0.13) $ (0.18) $ (0.36) 4.05 $ 5.63 $ 881 Technology $ Flexibiliy s Debt Service $ Building Reserve Permissive S Building Reserve Voled s Grand Total 0.00 30,000 30,000 5.63 $ 7.60 $ 1520 0.00 28,773 5.40 $ 28,773 5.40 $ 7.29 $ 14.58 0.00 19,776 3.71 $ (0.37) $ (0.44) $ 10.55 $ (1.00) (1.18) 20,163 4.08 (388) (0.50) $ 30,000 607 30,000 563 $ (0.59) $ 14.24 $ 998,960 202.23 $ 1,132,981 212.78 $ 134,020 28.48 This notice must also document the District's expected use of its Building Reserve State Major Maintenance levies and associated funding. This year, the District expects to use those proceeds to fund capital improvements as approved by the Board as well as operational costs of school safety. All estimates are based on the current year's taxable value with no increase, as required by state law. If the District's taxable value increases as expected, the mill and taxpayer cost increases will be less than presented here. These estimates are preliminary and changes are expected before the final budgets are set in August. Please contact the District Business Office at (406) 649-2311 if you have questions or need additional information. ST. REGIS SCH0OOL DISTRICT #1 NOTICE OF INTENT TO INCREASE NONVOTED LEVIES MARCH 2022 The St. Regis School District is committed to financial transparency. As an essential part of its budgeting process, the St. Regis School District Board of Trustees is authorized by law to impose levies to support its budget. State law requires the District to provide notice of its intent to increase non-voted levies in the ensuing fiscal year. However, understanding the District's tax structure requires considering all levies both voted and non-voted. This notice contains projections for all of the District's levies. 2021-22 Actual Leves 2022-23 Projecions Est Annual Tax Est. Annual Tax Impact$100K mpact $200K Fund Change Mills Mills Mills Change S home home General - BASE General - OverBASE S Transportation $ Bus Depreciation s 254,913 51.62 267,302 50.21 $ 12,389 (141) $ (1.90) $ (3.80) 353,046 7147 405,177 76.10 $ 52,130 4.63 $ 625 $ 12.50 6,030 (106) (3.12) $ (1.65) $ 1.04 $ 235,376 47.65 241,406 45.34 $ (231) $ (1.22) $ (6.24) (3.30) 2.08 82,106 16.62 82,000 15.40 $ Tuiton 24 2,689 0.54 7,000 1.31 $ 4,311 0.77 $ Adult Ed 20,666 4.18 21,548 (0.13) $ (0.18) $ (0.36) 4.05 $ 5.63 $ 881 Technology $ Flexibiliy s Debt Service $ Building Reserve Permissive S Building Reserve Voled s Grand Total 0.00 30,000 30,000 5.63 $ 7.60 $ 1520 0.00 28,773 5.40 $ 28,773 5.40 $ 7.29 $ 14.58 0.00 19,776 3.71 $ (0.37) $ (0.44) $ 10.55 $ (1.00) (1.18) 20,163 4.08 (388) (0.50) $ 30,000 607 30,000 563 $ (0.59) $ 14.24 $ 998,960 202.23 $ 1,132,981 212.78 $ 134,020 28.48 This notice must also document the District's expected use of its Building Reserve State Major Maintenance levies and associated funding. This year, the District expects to use those proceeds to fund capital improvements as approved by the Board as well as operational costs of school safety. All estimates are based on the current year's taxable value with no increase, as required by state law. If the District's taxable value increases as expected, the mill and taxpayer cost increases will be less than presented here. These estimates are preliminary and changes are expected before the final budgets are set in August. Please contact the District Business Office at (406) 649-2311 if you have questions or need additional information.