Advertisement

-

Published Date

March 27, 2024This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

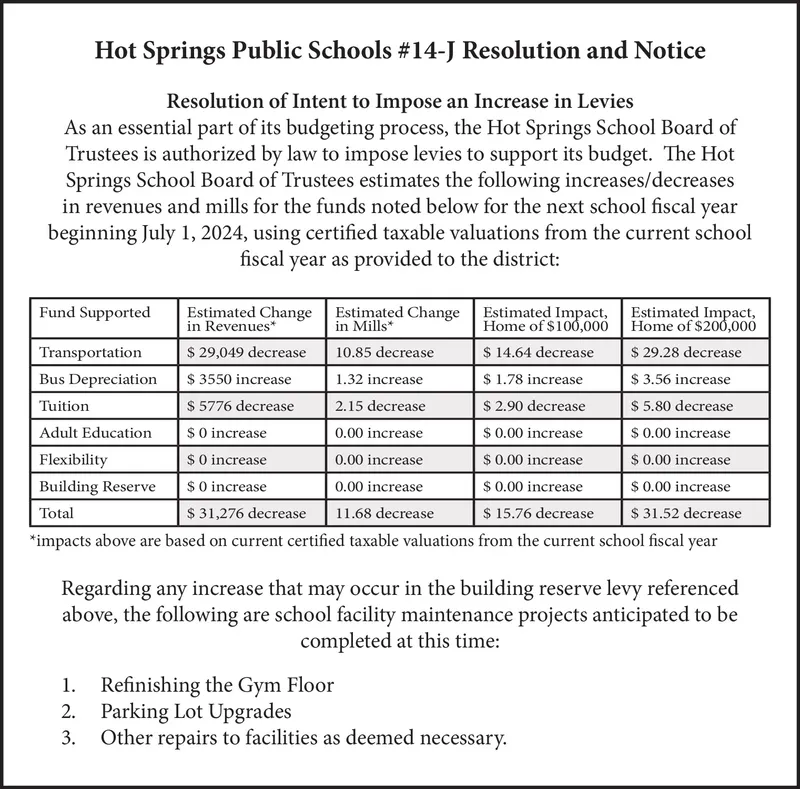

Hot Springs Public Schools #14-J Resolution and Notice Resolution of Intent to Impose an Increase in Levies As an essential part of its budgeting process, the Hot Springs School Board of Trustees is authorized by law to impose levies to support its budget. The Hot Springs School Board of Trustees estimates the following increases/decreases in revenues and mills for the funds noted below for the next school fiscal year beginning July 1, 2024, using certified taxable valuations from the current school fiscal year as provided to the district: Fund Supported Transportation Bus Depreciation Tuition Estimated Change in Revenues* Estimated Impact, Home of $200,000 $ 29.28 decrease $ 3.56 increase $ 5.80 decrease $0.00 increase $0.00 increase $0.00 increase $ 29,049 decrease $ 3550 increase $ 5776 decrease Estimated Change in Mills* 10.85 decrease 1.32 increase 2.15 decrease Adult Education Flexibility $ 0 increase 0.00 increase $ 0 increase 0.00 increase Building Reserve Total $ 0 increase 0.00 increase $31,276 decrease 11.68 decrease Estimated Impact, Home of $100,000 $ 14.64 decrease $ 1.78 increase $ 2.90 decrease $0.00 increase $ 0.00 increase $ 0.00 increase $ 15.76 decrease $ 31.52 decrease *impacts above are based on current certified taxable valuations from the current school fiscal year Regarding any increase that may occur in the building reserve levy referenced above, the following are school facility maintenance projects anticipated to be completed at this time: Refinishing the Gym Floor 2. Parking Lot Upgrades 3. Other repairs to facilities as deemed necessary. Hot Springs Public Schools # 14 - J Resolution and Notice Resolution of Intent to Impose an Increase in Levies As an essential part of its budgeting process , the Hot Springs School Board of Trustees is authorized by law to impose levies to support its budget . The Hot Springs School Board of Trustees estimates the following increases / decreases in revenues and mills for the funds noted below for the next school fiscal year beginning July 1 , 2024 , using certified taxable valuations from the current school fiscal year as provided to the district : Fund Supported Transportation Bus Depreciation Tuition Estimated Change in Revenues * Estimated Impact , Home of $ 200,000 $ 29.28 decrease $ 3.56 increase $ 5.80 decrease $ 0.00 increase $ 0.00 increase $ 0.00 increase $ 29,049 decrease $ 3550 increase $ 5776 decrease Estimated Change in Mills * 10.85 decrease 1.32 increase 2.15 decrease Adult Education Flexibility $ 0 increase 0.00 increase $ 0 increase 0.00 increase Building Reserve Total $ 0 increase 0.00 increase $ 31,276 decrease 11.68 decrease Estimated Impact , Home of $ 100,000 $ 14.64 decrease $ 1.78 increase $ 2.90 decrease $ 0.00 increase $ 0.00 increase $ 0.00 increase $ 15.76 decrease $ 31.52 decrease * impacts above are based on current certified taxable valuations from the current school fiscal year Regarding any increase that may occur in the building reserve levy referenced above , the following are school facility maintenance projects anticipated to be completed at this time : Refinishing the Gym Floor 2. Parking Lot Upgrades 3 . Other repairs to facilities as deemed necessary .